Human resources (HR) play a pivotal role in every organization. From recruiting and onboarding new employees to ensuring compliance with employment laws, the tasks performed by the HR department are critical for long-term success. However, like any other function, HR also comes with its share of risks that could potentially harm the business if not managed properly. This is where the concept of HR risk management comes into the picture.

Simply put, HR risk management refers to identifying, assessing, and minimizing risks arising from people management and employment-related issues. It helps create a safe and compliant work environment while shielding the company from unnecessary lawsuits, financial losses, and reputational damage. As organizations continue to operate in an environment of fast-paced changes and growing regulations, having a robust HR risk management strategy has become imperative.

This comprehensive guide will help you understand the fundamentals of HR risk management. We'll discuss why it matters, common types of HR risks, best practices to manage them, and how to develop an effective HR risk management plan. By the end, you'll have a clear idea of integrating risk assessment and mitigation strategies into your people practices. Let's get started!

Ignoring HR risks could lead to dire consequences for any business. Here are some key reasons that highlight the importance of a proactive HR risk management approach:

Employment laws are expanding at a rapid pace to protect employee rights and welfare. Non-compliance not only affects employee morale but can also result in hefty penalties. An HR risk management strategy helps analyze legal obligations, flag non-compliance areas, and integrate controls to stay compliant.

Costly employee lawsuits due to discrimination, harassment, wage issues, etc. can burn a huge hole in company finances. Proactively addressing HR risks through training and policies can prevent such lawsuits.

Adverse publicity due to risky events like data breaches or toxic workplace culture makes it difficult to attract and retain talent. HR risk management safeguards the employer brand.

Risks concerning employee safety, security incidents or natural disaster preparedness could potentially disrupt operations. Mitigation plans as part of HR risk management ensure smooth business functioning.

Identifying emerging HR trends and analyzing their impact aids informed policymaking. It allows adopting preemptive measures rather than reactive firefighting.

A risk-aware HR nurtures an environment where people can perform to their fullest potential without any threats to their well-being or livelihood. This has a positive influence on productivity and retention.

In a nutshell, embedding HR risk management in policies and procedures goes a long way in protecting a company and helping it achieve its long-term goals. The rewards far outweigh the efforts invested in evaluating and minimizing risks.

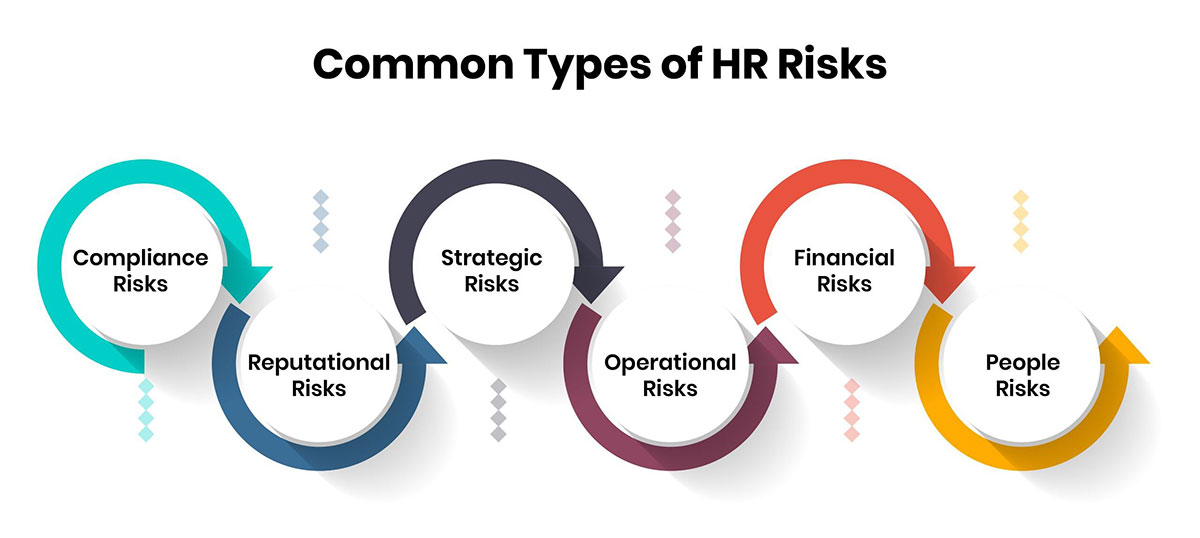

To design a targeted risk management strategy, understanding prevalent risk categories is important. Some major HR risks that frequently impact organizations include:

Non-alignment of HR practices with evolving laws around areas like hiring, benefits, leave, accommodations etc. can make a company non-compliant. Non-compliance with regulations can lead to hefty penalties. It is important for companies to carefully analyze all existing and upcoming laws related to various aspects of employment to ensure that HR policies and processes are updated accordingly. Regular training of relevant employees and conducting audits can help identify any gaps and address them proactively before they become compliance issues. Documenting the due diligence taken also helps in case of any investigations.

Issues relating to the employer brand like perceptions of unfair treatment, and lack of diversity hamper talent attraction and retention. In today's socially and politically charged environment, instances of discrimination, uneven practices etc can quickly go viral on social media and damage the reputation of the brand as an employer of choice. This can negatively impact the ability to source, hire and keep top talent. Implementing robust policies against unfair treatment, diversity & inclusion initiatives and being transparent in communications can help mitigate reputational risks. Conducting employee engagement surveys and addressing issues proactively is important.

Not assessing the impact of trends like remote working, and the gig economy on HR strategies leads to misaligned initiatives. It is important for the HR function to constantly scan the external business environment and identify emerging trends that can disrupt existing ways of working. Failure to do so can result in HR strategies, policies and programs becoming outdated and irrelevant. This may affect the ability of the workforce strategies to support the organizational strategies and objectives. Regular environmental scanning, benchmarking best practices, pilot projects and review of strategic plans can help address this risk.

Everyday risks like data security lapses, ineffective hiring, and lack of emergency preparedness threaten operations. Robust systems and procedures are required to ensure seamless HR operations. Risks like data breaches can lead to financial and reputational damage. Ineffective recruiting may result in time and cost overruns or hiring the wrong candidates. Lack of business continuity plans can impact response during crises. Developing policies, training employees, conducting audits and making improvements basis the findings can optimize HR operations management and mitigate associated risks.

Costly litigations, rising healthcare costs, and incorrect compensation practices burden finances. Non-compliance issues often result in expensive fines and litigation costs. Not proactively managing healthcare costs or reviews of compensation strategies in light of market benchmarks and organizational performance can increase the financial burden. Risk practices like compliance audits, contract management protocols and regular process reviews are required to minimize financial exposure.

Risks concerning employee well-being like discrimination, harassment, and mental health impact productivity adversely. Examples include loss of productive time due to injuries, stress or discrimination at the workplace. This can have ripple effects on motivation, performance and retention of talent. It is important to develop sound policies against unfair treatment, provide EAP resources, conduct regular training, and investigate complaints to protect employee well-being and consequently the human capital of the organization. Promoting a healthy work culture and inclusive work environment is key to mitigating people risks.

These categories cover a wide gamut of HR challenges. Understanding their root causes helps create focused mitigation tactics during the risk management planning stage.

With awareness around prevalent HR risks and their implications, here are some effective practices to put risk management processes in place:

Regular risk assessments help identify potential risks in advance so mitigation planning can begin. Risk assessments should be conducted at least annually using techniques like surveys, interviews and reviews of past incidents. Surveys can be designed to understand employees' perspectives on various risks they face at work. The risks uncovered through these techniques should be documented and prioritized based on their likelihood of occurrence and potential impact.

Once risks are identified, clear roles and ownership need to be defined for risk management. For example, the HR head can be made responsible for overall compliance and risk oversight. Departmental managers could be made accountable for risks specific to their functions. Responsibilities for compliance with various legal and statutory requirements should be allocated to concerned teams like recruiting, compensation etc.

Technology can be a powerful enabler for HR risk management. Applicant tracking systems automate and record recruiting processes for audit trail and control over unfair biases. HR information systems maintain employee data centrally for security and privacy. Technology streamlines processes bringing in consistency, improves monitoring capabilities and frees up resources otherwise spent on manual tasks.

Comprehensive policies frame the 'do's and don'ts' around key risk areas. For example, a data privacy policy specifies collection, use, storage and the protection of sensitive employee information. A related party transactions policy prevents conflicts of interest.

Controls embedded in processes ensure policy adherence. For instance, approvals and reviews in critical areas like performance appraisals, and compensation changes mitigate biases. Segregation of duties and access controls prevent errors/fraud risks in financial transactions. Regular communication makes policies and controls effective.

Independent internal audits evaluate the effectiveness of existing controls in managing risks. Areas like performance reviews, salary administration, and recruitment which involve subjective judgments are priority audit subjects. External audits by statutory agencies provide an objective third-party perspective on the program. An effective audit culture strengthens reliance on controls and promotes a proactive risk-anticipating mindset.

Compliance training through modules covering relevant policies and procedures enables employees to identify risks and take appropriate actions in their roles. For example, privacy training equips employees to handle sensitive customer information with care. Soft skills training contributes to a more harmonious and productive workplace by mitigating interpersonal conflicts. Functional training on using tools like the HRIS and performance management system trains employees on building in-built controls within business-as-usual.

Tracking quantitative metrics provides early warnings for risks yet to surface or exacerbate. For instance, a spike in attrition or turnover in certain roles could indicate job dissatisfaction or compensation issues. Qualitative indicators from satisfaction surveys, feedback, exit interviews and social media also provide insights to nip risks in the bud. Speedy leadership response based on trended KRIs strengthens the control environment proactively instead of just reactively.

Crises like natural disasters, cyberattacks or pandemics pose significant business continuity risks. Simulated drills activate emergency plans to test preparedness for various scenarios. Leaders and cross-functional teams participate to plug gaps. Crisis communication protocols ensure stakeholders receive pertinent, timely, sensitive information from authenticated sources to make appropriate decisions.

The internationally recognized COSO framework helps align the HR risk management program with globally followed internal control strategies, bringing credibility. Other standards like ISO 27001 for information security management are referred to achieve best-in-class processes. For example, leading practices observed in an industry-specific organization could be customized for a particular organization. Adaptability to changes facilitates continued operational excellence.

Periodically reevaluating the risk management program ensures continued relevance and readiness for emerging scenarios. Effectiveness is gauged through metrics like reduced incidents, audit issues, and lower insurance costs. Interviews across levels provide participants' perspectives on program strengths and enhancement opportunities. Economic, and geopolitical environment scans identify new and evolving risks requiring fresh consideration.

These practices establish a culture of risk awareness, help align people and processes according to risks and protect a company's operations as well as reputation.

The ultimate step is to concretize the risk management strategy into an implementable plan. Here are the key elements to cover while creating one:

The first step is establishing a clear risk governance structure. This involves outlining the roles and responsibilities of various risk owners and oversight committees. For example, defining that the HR director will own people risks while the compliance manager will own regulatory risks. A risk steering committee consisting of C-suite executives provides holistic oversight of the entire risk universe and accountability.

Documenting all possible risk categories and sub-risks in a risk universe is another important element. For HR, risks may include talent acquisition issues, employee relations problems, compliance breaches, safety incidents, and more. Specific risks under talent acquisition could involve failure to hire needed skills, high turnover rates, or non-compliance in recruiting practices. The risk universe acts as a foundational reference for all subsequent risk management activities.

A comprehensive risk assessment evaluates the likelihood, potential impact, and velocity of each risk identified in the universe. Tools like risk rating matrices or surveys can gather input from cross-functional stakeholders to score risks. This prioritizes which deserve immediate focus. For instance, risks with high likelihood and impact like data privacy breaches or unethical conduct would rise to the top.

Mitigation strategies are then outlined for priority risks. These involve preventive and detective controls to reduce the chances of a risk materializing or escalating. Responsibilities for executing controls are assigned to relevant teams or individuals. Clear timelines, success metrics, and reviews keep controls effective. For example, implementing training on anti-bribery policies and auditing vendor onboarding processes may help address regulatory non-compliance risks.

Business continuity and disaster recovery plans form a critical part of crisis management preparations. Scenarios like natural disasters, cyberattacks or pandemics are planned for with guides on activations, team responsibilities, and facilities management. Communication protocols ensure stakeholders receive timely, accurate updates during disruptions.

Monitoring frameworks keep risks and controls under close, ongoing scrutiny. Regular internal audits and external assessments verify the design and operating effectiveness of controls. Key risk metrics like turnover rates, leave utilization, and complaint volumes are tracked with predefined thresholds that trigger corrective actions. Monitoring helps catch weaknesses for improvement.

Complimenting the above is a carefully thought out training procedure. Training content and delivery methods are tailored to different employee levels and their specific risk understanding needs. For instance, all employees must complete basic compliance courses while managers receive custom people manager training.

Regular risk reporting and communication help integrate the risk culture across the organization. The CRO or risk team leads monthly or quarterly reporting to varied governance and management forums. Two-way communication gets feedback to further refine the program.

An annual evaluation uses metrics like reduction in high-severity incidents or near misses to benchmark program effectiveness against goals and peers. Improvement plans continually enhance the HR risk management system based on learnings, ensuring it remains robust and pertinent.

Sign-offs from the board and senior leaders provide final approval and accountability before systematic roll-out of the now living document across HR and adjacent functions. Automating the plan in a centralized risk management software maintains real-time control and agility to adapt to changing scenarios, with periodic reviews and updates keeping it robust over time.

In today's volatile, uncertain and complex business environment, a proactive stance towards HR risks has become vital to sustain competitiveness. A comprehensive HR risk management approach as discussed benefits businesses of all sizes in numerous ways.

While establishing and embedding such a system requires investment of efforts and resources, done right it enables safeguarding the well-being of employees as well as the interests of the company. Most importantly, such foresighted planning establishes people practices founded on the principles of responsibility, care and resilience assuring longevity of the organization.

Embracing HR risk management diligently makes way for harnessing the true value people offer through their capabilities, innovation and passion by shielding distractions of potential HR challenges. It is towards this end goal that the need to embed HR risk oversight systematically across people strategies cannot be over emphasized.